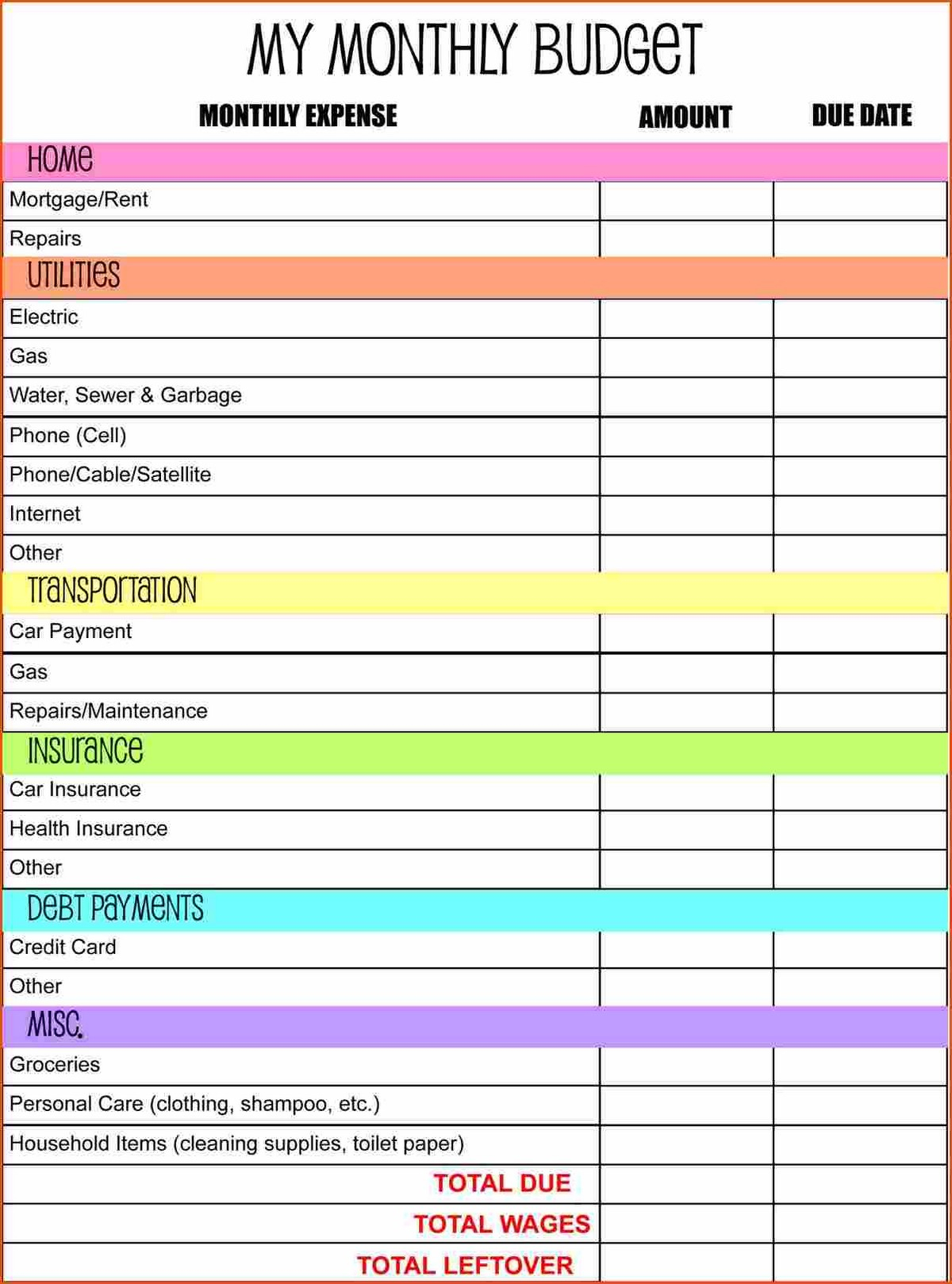

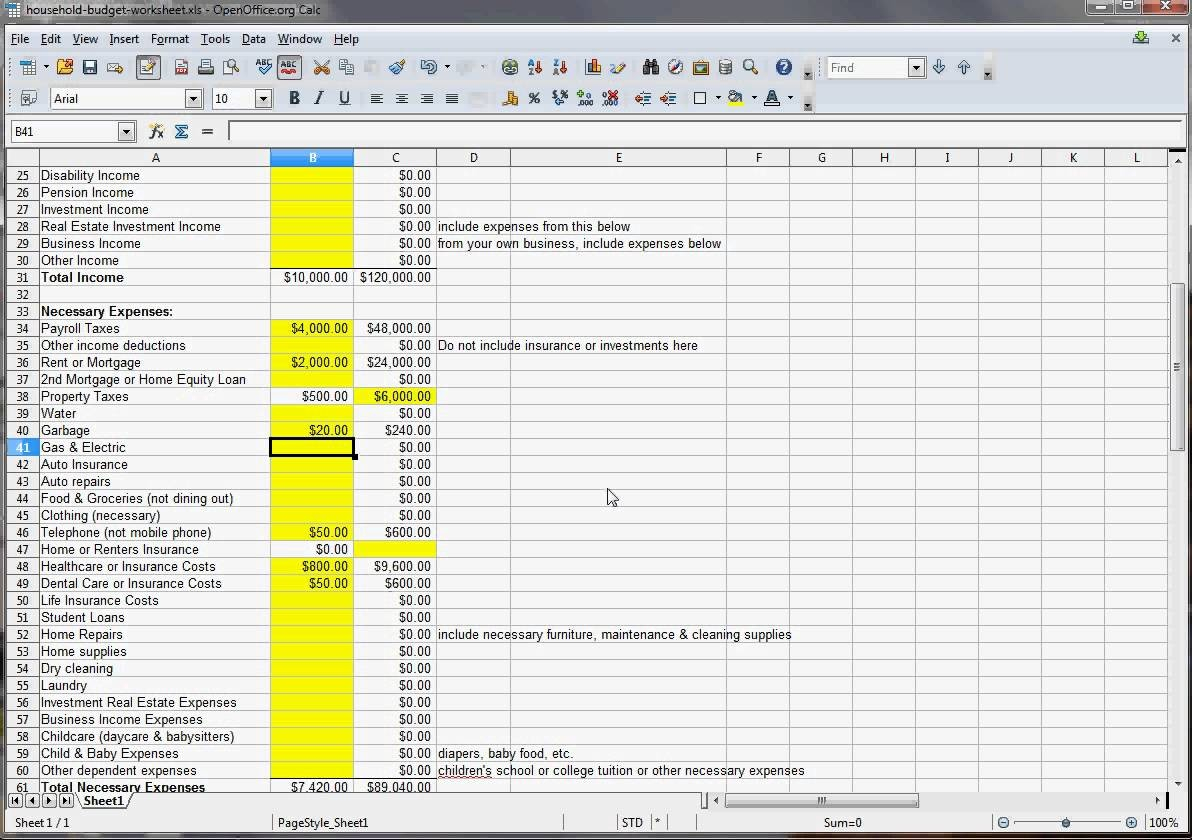

However, if you’re falling short each month or anticipating large expenses, it’s time to make some spending and saving changes. If you’re comfortable with your current spending and saving habits, your way forward is simple: structure your current budget, be aware of your goals and expenses, and continue what you’ve been doing. Step 5: Adjust Your Spending and Saving Habits Accordingly How much do you want to have saved in five years? What about in 10 years? What about when it’s time to retire? By thinking about and planning your finances ahead of time, you’re more likely to achieve these goals. Whatever your financial priorities may be, write them down (you can use our financial goals worksheet), and devise a plan to achieve these goals.ĭetermine how much you should be saving. What are you working toward? An early retirement? A stable home life? Maybe your sights are set on certain luxuries. Mitigate the stress of a potential disruption to your cash flow by keeping a separate savings account with at least 3 months’ living expenses in liquid, easily accessible cash.Ĭonsider your financial goals. You never know what emergency might impact your finances and when. Much as we wish we could, no one can see the future. Setting aside savings in a specified fund is a hallmark of responsible money management. Then, determine which of these expenses are ‘fixed’, ‘regular that varies’, or ‘irregular.’ Regardless of what medium you use to budget, it’s important to divide down your expenses into categories such as home, food, health, transportation, personal/family, and other. When doing this, it’s best to use a printable budget worksheet such as this one to stay organized. This is the most fun part of making a budget (because making a budget is so fun, right?) because you get to see exactly where all your hard-earned cash is going. To do this, subtract all your deductions from your income. What’s left over is the money you’re able to spend and budget with. To identify your net income, you need to determine what you’re taking home after taxes and any other deductions such as your 401(k) contributions. We’ve also provided printable budget worksheets to help you stay organized along the way.

#Household budget printable budget worksheet dave ramsey how to#

In this guide, we’re going over each step of how to create a household budget. By keeping track of what you spend each month, you’ll know whether or not it’s necessary to adjust your spending and saving habits.

If you want to flourish financially, creating a household budget is a must.

0 kommentar(er)

0 kommentar(er)